Frequently Asked Questions Answered About Financial Statements Valuation

4 out of 5

| Language | : | English |

| File size | : | 913 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 79 pages |

| Lending | : | Enabled |

| Hardcover | : | 200 pages |

| Item Weight | : | 14.4 ounces |

| Dimensions | : | 6.25 x 0.75 x 9.25 inches |

Financial statements valuation is a critical aspect of financial analysis, providing insights into the financial health and performance of businesses. However, understanding the complexities of financial statements and valuation methods can be challenging. This article aims to address frequently asked questions about financial statements valuation, empowering readers to make informed decisions and gain a deeper understanding of this essential topic.

What are Financial Statements?

Financial statements are formal records that provide a comprehensive overview of a company's financial position and performance. They typically include:

- Balance Sheet: Summarizes a company's assets, liabilities, and equity at a specific point in time.

- Income Statement: Reports a company's revenues, expenses, and net income over a period of time.

- Cash Flow Statement: Shows how a company generates and uses cash over a period of time.

Why is Financial Statements Valuation Important?

Financial statements valuation is essential for several reasons:

- Investment Decisions: Helps investors assess the value of a company before making investment decisions.

- Credit Analysis: Enables lenders to evaluate a company's creditworthiness and ability to repay debts.

- Business Transactions: Provides a basis for determining the fair value of businesses in mergers, acquisitions, and other transactions.

- Tax Planning: Assists companies in optimizing their tax strategies and minimizing tax liabilities.

- Performance Evaluation: Allows stakeholders to assess a company's financial performance and track progress over time.

What are the Key Valuation Methods?

There are several valuation methods used to determine the fair value of financial statements, including:

- Asset-Based Valuation: Considers the value of a company's tangible and intangible assets.

- Income-Based Valuation: Estimates a company's value based on its future income potential.

- Market-Based Valuation: Compares a company's financial performance to similar companies in the same industry.

- Discounted Cash Flow Analysis: Projects a company's future cash flows and discounts them to present value.

What are the Challenges in Financial Statements Valuation?

Financial statements valuation can be challenging due to factors such as:

- Availability of Reliable Data: Ensuring that financial statements are accurate and reliable is crucial.

- Subjectivity of Assumptions: Valuation methods rely on assumptions that can impact the final outcome.

- Influence of Market Conditions: Market fluctuations can significantly affect the value of a company.

- Complexities of Financial Reporting: Different accounting principles (e.g., GAAP, IFRS) can affect financial statement presentation.

How Can I Enhance the Accuracy of Financial Statements Valuation?

To enhance the accuracy of financial statements valuation, consider the following best practices:

- Use Multiple Valuation Methods: Employing different methods provides a more comprehensive assessment.

- Consider Sensitivity Analysis: Test the impact of different assumptions on the valuation outcome.

- Seek Expert Advice: Consult with experienced financial professionals to provide objective perspectives.

- Regularly Update Valuations: Monitor changes in financial performance and market conditions to adjust valuations accordingly.

Financial statements valuation is a multifaceted and essential aspect of financial analysis. Understanding the key concepts, valuation methods, and challenges involved empowers individuals to make informed decisions and gain valuable insights into the financial health of businesses. By leveraging the information provided in this article, readers can enhance their financial literacy and navigate the complexities of financial statements valuation with greater confidence.

4 out of 5

| Language | : | English |

| File size | : | 913 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 79 pages |

| Lending | : | Enabled |

| Hardcover | : | 200 pages |

| Item Weight | : | 14.4 ounces |

| Dimensions | : | 6.25 x 0.75 x 9.25 inches |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Joanna Brooks

Joanna Brooks Misty Moncur

Misty Moncur John Gribbin

John Gribbin Paul Woods

Paul Woods John J Watkins

John J Watkins Jim Loomis

Jim Loomis John L Bell

John L Bell Krista Dana

Krista Dana Jim Kachenmeister

Jim Kachenmeister John Alcock

John Alcock Joel Tyler Headley

Joel Tyler Headley John Davidson

John Davidson Jim Harkins

Jim Harkins M Schwartz

M Schwartz Matt Dembicki

Matt Dembicki Karel Hrbacek

Karel Hrbacek Joel N Franklin

Joel N Franklin Klaus Wagenbach

Klaus Wagenbach Leland Wilkinson

Leland Wilkinson Robert Murillo

Robert Murillo

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Clarence BrooksKakuriyo Bed & Breakfast for Spirits: A Culinary Adventure in the Hidden...

Clarence BrooksKakuriyo Bed & Breakfast for Spirits: A Culinary Adventure in the Hidden...

Griffin MitchellExtraction of Quantifiable Information from Complex Systems: A Comprehensive...

Griffin MitchellExtraction of Quantifiable Information from Complex Systems: A Comprehensive... Cole PowellFollow ·2.1k

Cole PowellFollow ·2.1k Mario BenedettiFollow ·18.2k

Mario BenedettiFollow ·18.2k David BaldacciFollow ·7.1k

David BaldacciFollow ·7.1k Isaiah PriceFollow ·10.1k

Isaiah PriceFollow ·10.1k Robert FrostFollow ·17.4k

Robert FrostFollow ·17.4k Curtis StewartFollow ·9.3k

Curtis StewartFollow ·9.3k Derek CookFollow ·3.2k

Derek CookFollow ·3.2k W.H. AudenFollow ·16.3k

W.H. AudenFollow ·16.3k

Joshua Reed

Joshua ReedTake Your Marketing Business Into The Next Level

Are you ready to...

Aaron Brooks

Aaron BrooksFrom Fourier to Cauchy-Riemann: Geometry Cornerstones

From Fourier to Cauchy-Riemann: Geometry...

Orson Scott Card

Orson Scott CardUnveiling the Art of Mitigation Banking: A Comprehensive...

In the intricate dance between...

Victor Hugo

Victor HugoUnleash Your Creativity: A Journey Through the Enchanting...

Prepare to be captivated as we...

Duncan Cox

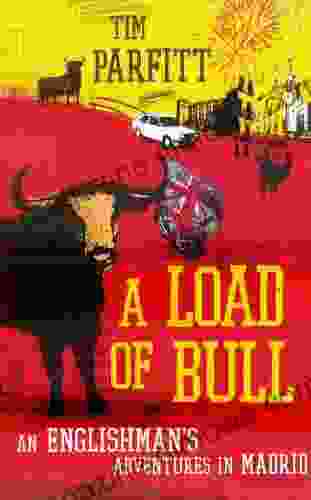

Duncan CoxLoad of Bull: An Englishman's Adventures in Madrid

By Simon Bunce ...

4 out of 5

| Language | : | English |

| File size | : | 913 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 79 pages |

| Lending | : | Enabled |

| Hardcover | : | 200 pages |

| Item Weight | : | 14.4 ounces |

| Dimensions | : | 6.25 x 0.75 x 9.25 inches |